“You can't improve what you don't measure."

-Peter Drucker

Knowing your actual starting point is key to successful wealth building. Think of it like a diet plan. How will you measure progress if you don't know your starting weight? It will be challenging to determine if your actions are effective and if any adjustments are needed. Creating a net worth statement is essential regardless of your income or age. This financial snapshot highlights your current position and identifies areas for improvement, as well as the distance remaining to reach your goals.

Your net worth = what you OWN minus what you OWE

If you haven't created one in the past year, now is a great time to update or create yours. Don't worry about making it perfect, as even a rough draft can offer valuable insights, and this will be updated as you go. This will help you track progress and stay motivated as you work towards your goals. Feel free to use the provided template or design your own, attaching it to this workbook for easy access. Remember to record your net worth number on the front cover of your Annual Financial Checkup workbook for quick reference in the future.

Net Worth Statement Suggestions:

Do NOT include social security or pensions in your net worth, as these are only promises of future income. Since these are not guaranteed, they are not generally considered assets. However, they should be included as a footnote.

Do NOT include kids’ college savings or other funds not intended for you on your net worth statement. Again, these should be included as a footnote.

Do write what you are thankful for on each net worth statement, as this can be a fun way to look back and appreciate the progress. (This was addressed in the previous step, Question #2 – What are you thankful for? You can document this on the front cover of this Annual Financial Checkup workbook.)

Do keep a record of all accounts with access details alongside your net worth statement. This will help aid loved ones in case of emergencies. (This is also discussed later in Section 4–Safeguarding your Legacy in Question #4–Have you created a “What If” folder/binder?)

Use the template attached below to calculate your Net Worth or create your own. Be sure to attach it to your Annual Financial Checkup workbook, along with documenting your net worth number (and a few things you are thankful for) on the front cover for easy reference.

Downloadable Worksheets

Net Worth Template (PDF)

This worksheet is also included in the Annual Financial Checkup Section 1 bundle.

Net Worth Template (Excel format)

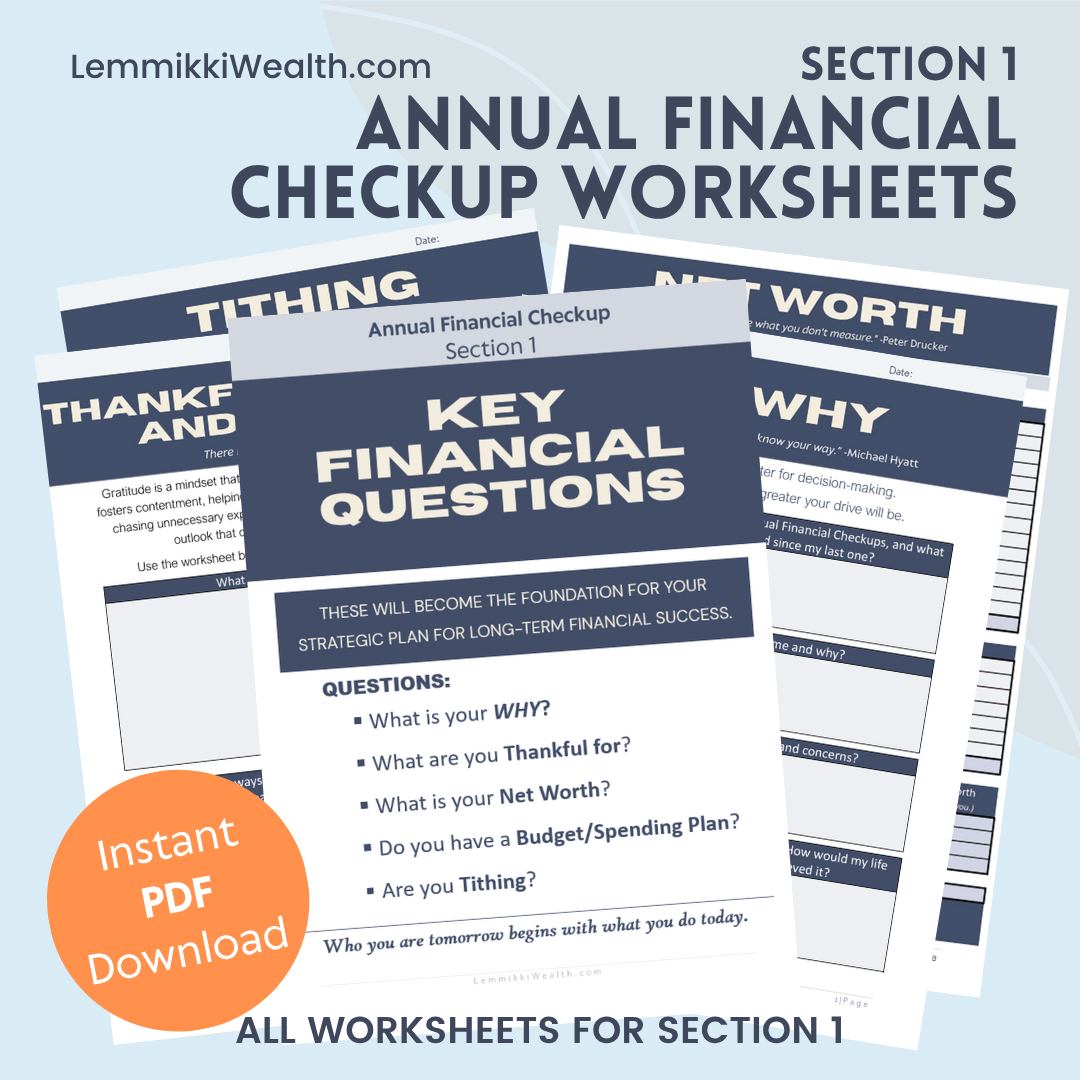

Section 1 Annual Financial Checkup bundle.

This bundle includes all the worksheets for Section 1, including the Net Worth templates, in a single, easy-to-use PDF download.