“When you know your why, you’ll know your way.”

-Michael Hyatt

Knowing your WHY is a crucial first step to building wealth. Without a clear understanding of why you're doing something, it’s easy to lose focus when life gets hard and want to give up. A strong, compelling why will keep you motivated, especially during challenging times. It should motivate you to continue working hard and make it easier to say “no” to things, so the stronger your why, the greater your drive will be.

When your why is powerful, your how becomes easier.

Here's why having a strong WHY matters:

Motivation

Willpower fades, but purpose sticks. Having a strong why is like installing an emotional GPS for your goals. It's what gets you out of bed when the goal feels far away, especially when the path gets rocky. Saving money isn’t always fun, but when you focus on a goal that truly excites you, the sacrifices start to feel more like a step forward. A meaningful goal can shift your mindset, making spending less tempting and saving feel more rewarding.

Resilience

The road to anything meaningful is rarely a straight line. Your why is what anchors you when progress slows, detours appear, or life throws curveballs. It reframes failure as feedback and transforms delays into lessons. It reminds you that a temporary setback doesn’t cancel a long-term vision. When your financial journey hits a rough patch, your why helps you persevere with purpose instead of quitting out of frustration.

Focus through the noise

There are a million distractions, opinions, and shiny detours in life. Your why acts like a filter—it keeps your attention on what truly matters and helps you say “no” to what doesn’t serve the bigger picture.

When you begin planning with your goals in mind, you will be surprised how things will start aligning. It activates a shift in your mindset, prompting your brain to notice opportunities that can move you toward your desired life.

In short, your why is more than a reason—it’s your foundation. You’re not just setting a goal, you’re anchoring it in your heart, and this is where the real power kicks in. It will ground your actions, fuel your perseverance, and give your financial journey lasting meaning.

Turn your aspirations into a roadmap.

Writing It Down Changes Everything

There is power in written goals. Research suggests that you’re more likely to achieve your goals if they are written down. Written goals transform vague intentions into concrete commitments. It helps clarify what you truly want, keeps your focus sharp, and turns big dreams into actionable steps. Additionally, writing down your goals creates a sense of accountability, and there's power in revisiting them regularly to track progress, adjust your course, and stay motivated. Think of it as planting a flag for your future self to aim toward.

Here are a few tips for writing down your goals.

Be specific: Instead of writing vague goals like "save more money" or "find a better job," be specific, like Pay off $5,000 in debt within the next 12 months, Save $10,000 or increase retirement contributions to 15% within the next 2 years, Save $30,000 for a down payment on a home within the next 2 or 3 years, Secure a job in (desired field), etc.

Being specific will help you:

Create a Clear Plan: Defining your goals allows you to structure a detailed roadmap for success. When you know exactly what you're working toward, it becomes easier to prioritize your actions.

Track Progress & Recognize Milestones: Instead of wondering if you're making progress, specific goals help you measure success. You can see how close you are to achieving your target and adjust your strategies as needed.

Build Accountability & Motivation: Setting precise goals reinforces your commitment and keeps you focused. Seeing a clear number or deadline creates a sense of urgency and personal responsibility.

Celebrate Small Wins: Clear benchmarks make it easier to recognize and celebrate milestones along the way. Acknowledging progress keeps you motivated and confident in your financial journey.

Write your goals down somewhere you will see them frequently, such as in a notebook, on a whiteboard, or on a sticky note on your mirror or computer.

Review your goals regularly: Set aside time frequently to review your goals and track your progress, and you’re in luck because this Annual Financial Checkup is for precisely that! Reviewing this course or these questions at least once a year will help you stay focused and motivated to achieve your goals.

Bring your dreams to life!

Use the worksheets below to record your WHY and future goals, and attach them to your Annual Financial Checkup workbook for easy future reference. There is also an extra “WHY” space on the worksheets that you can use to display where you will see it frequently. You may even tape a copy to your mirror, put it in your wallet, or save a copy of it on your phone to look at when you’re out shopping, etc. Whatever it takes to help you remember why you are doing what you’re doing.

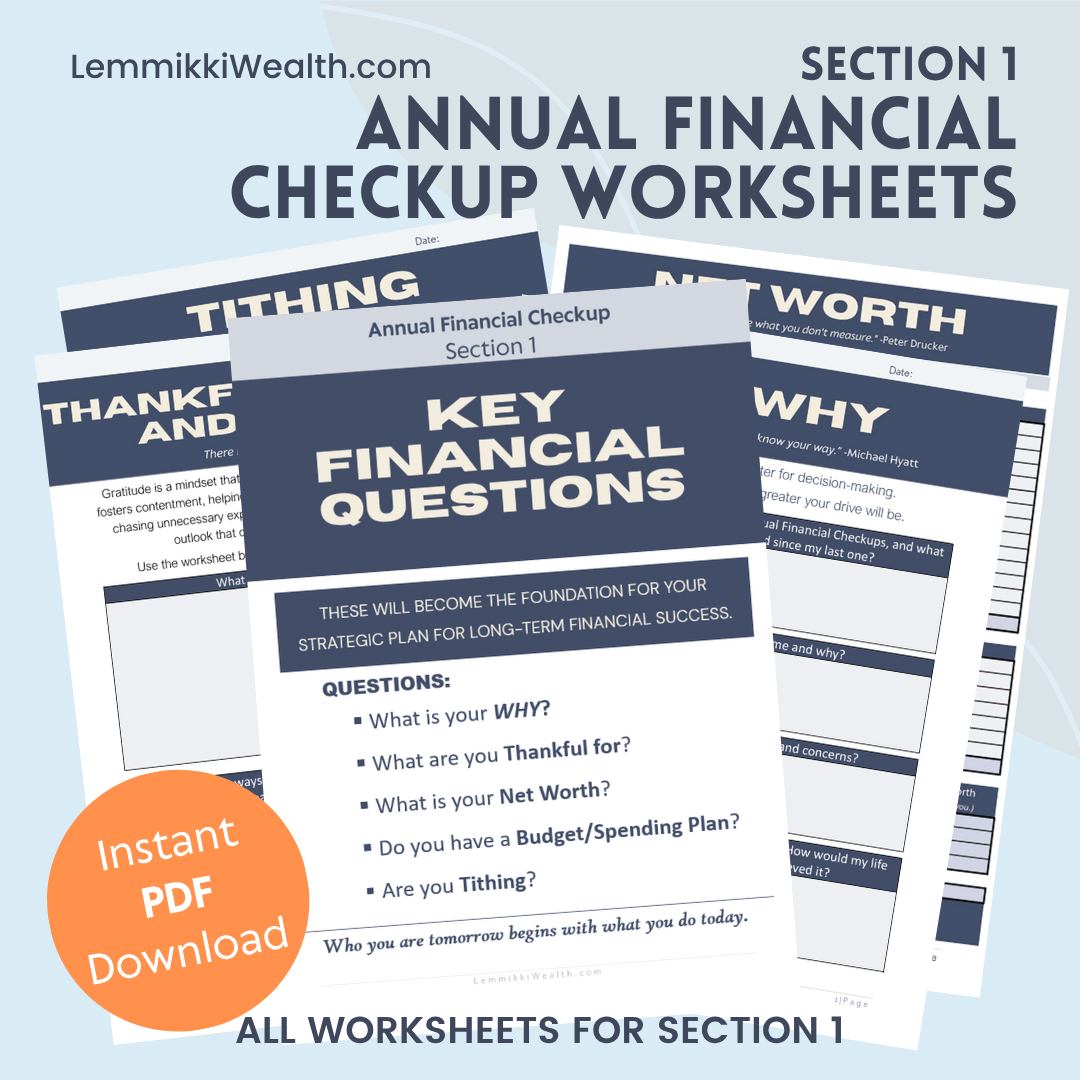

Downloadable Worksheets

MY WHY Worksheet

This worksheet is also included in the Annual Financial Checkup Section 1 bundle.

Section 1 Annual Financial Checkup bundle.

This bundle includes all the worksheets for Section 1, including the MY WHY worksheet, in a single, easy-to-use PDF download.