“If you don’t tell your money where to go, you’ll wonder where it went.”

-Dave Ramsey

What is a Budget/Spending Plan?

A budget/spending plan is more than just a list of income and expenses; it’s a strategic plan or roadmap for your financial future. A budget will also help you identify areas where you may be hemorrhaging money so that you can stop the bleeding. Having a budget or spending plan will help you prioritize essential expenses and savings and avoid unnecessary spending. This can help you stay on track with your financial goals. Additionally, cutting back on non-essential expenses can better position you to capitalize on opportunities that may arise during a market crash or recession, essentially accelerating your path to financial independence.

A well-structured budget or spending plan is one of the most powerful tools at your disposal.

While some financial voices may dismiss traditional budgeting, lasting success requires intention. Think of your household like a business, and just like any business, the results reflect the effort you put in. Once you’ve built momentum and reached a level of financial independence, your need for detailed budgeting may lessen, and by then, the good habits you’ve created should continue to serve you.

Here are a few basic steps for creating a well-structured budget:

Track Your Expenses: This is a crucial step in building wealth, particularly at the beginning of your financial journey. This will help you identify spending patterns and reveal areas for improvement. While this may feel tedious or overwhelming at first, the discipline you develop now will lay a strong foundation for everything that comes next.

Identify your essential expenses. These are the non-negotiable costs that you must cover each month, such as:

Housing: Rent or mortgage payments, utilities, and maintenance.

Food: Groceries and dining essentials.

Transportation: Car payments, fuel, public transit, and maintenance.

Healthcare: Insurance premiums, medications, and medical bills.

Allocate Savings: Once you’ve accounted for your essential expenses, the next step is to allocate funds toward savings. This includes:

Emergency Fund: Aim to save at least three to six months’ worth of living expenses.

Retirement Savings: Contribute regularly to retirement accounts like 401(k)s or IRAs.

Short-Term Goals: Save for upcoming expenses such as vacations, home repairs, or a new car.

Cut Back on Unnecessary Spending: Review your discretionary spending to identify areas where you can cut back. This might include:

Entertainment: Streaming services, dining out, and hobbies.

Shopping: Clothing, gadgets, and other non-essential purchases.

Subscriptions: Evaluate and cancel any unused or unnecessary subscriptions.

Regularly review and adjust your budget to ensure you are meeting your objectives and making progress toward your long-term goals.

Intentional Living Starts with a Plan

Now is the time to create a budget or spending plan if you don’t already have one. While a copy can be attached to your Annual Financial Checkup workbook, this document should be reviewed and updated several times a month. Keep your working version easily accessible—ideally in the spot where you most often pay your bills—for easy updating.

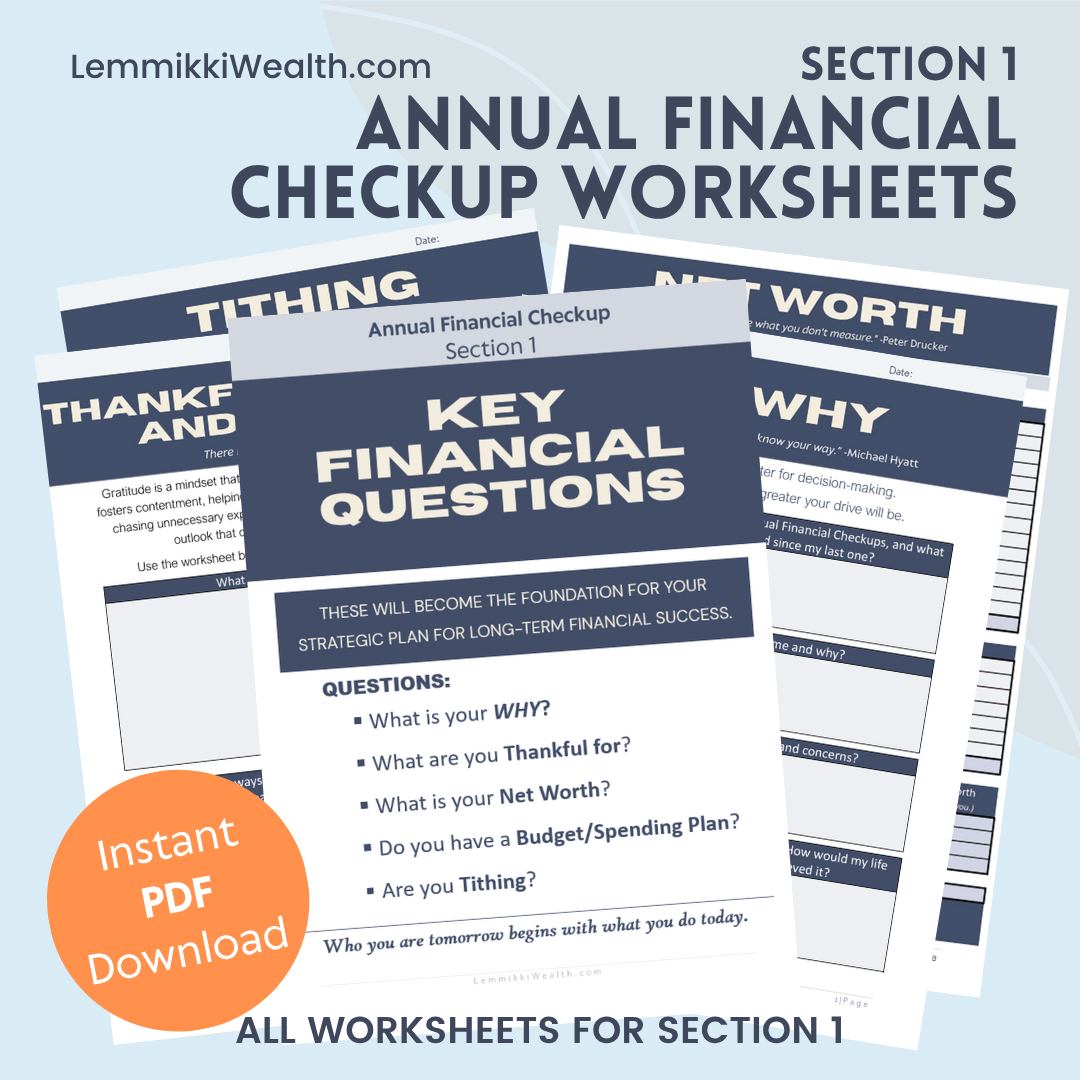

Downloadable Worksheets

Check out these budgeting/spending tracker worksheets to get started.

Section 1 Annual Financial Checkup bundle.

This bundle includes all the worksheets for Section 1 (excluding budgeting worksheets) in a single, easy-to-use PDF download.