Your Journey, Your Progress

There are numerous opinions on managing money, which can easily become overwhelming to navigate. One of the most important things to remember is that personal finance is, at its core, personal; therefore, what works for one person may not necessarily work or be best for another. We are all at different stages of life, find value in various aspects, and have varying risk tolerance levels.

These steps were derived using a blend of insights to guide you through the process, allowing YOU to choose the best path for YOU.

How do you eat an elephant? One bite at a time.

At first glance, these may feel like a lot, but don’t let them become overwhelming. Remember, not everything may apply to you, or they may not apply to you at every stage in life. The goal is consistency. Take this one step at a time, and you’ll be surprised by your progress in just a few years.

Key Reminders Before You Begin

1. Review these steps at least once a year.

This will enable you to make timely adjustments to your financial plan.

Life is constantly evolving—whether through marriage, having children, career shifts, or relocations—and each change can significantly impact your financial situation. By assessing real-time insights, you can make more informed choices in a timely manner, ensuring you stay in control for lasting financial success.

It will help build confidence.

Many feel self-conscious about their finances, mainly because money is closely tied to security and success. Whether it's concerns about debt, savings, or investing, financial decisions can feel overwhelming and even intimidating. Regular reviews will help replace uncertainty with confidence, helping you make informed choices based on your own priorities rather than comparisons. As your financial literacy grows, decisions become less intimidating, empowering you to take full control of your future.

2. Keep a record of your growth.

This will allow for visible progress, which can help fuel motivation.

While reflection isn’t always easy, it can be a powerful motivator. Finances, especially when we are young, can be very slow-moving, and often progress is hard to see. Revisiting past decisions can help make your growth more visible and help reinforce your momentum. Keep moving forward with confidence.

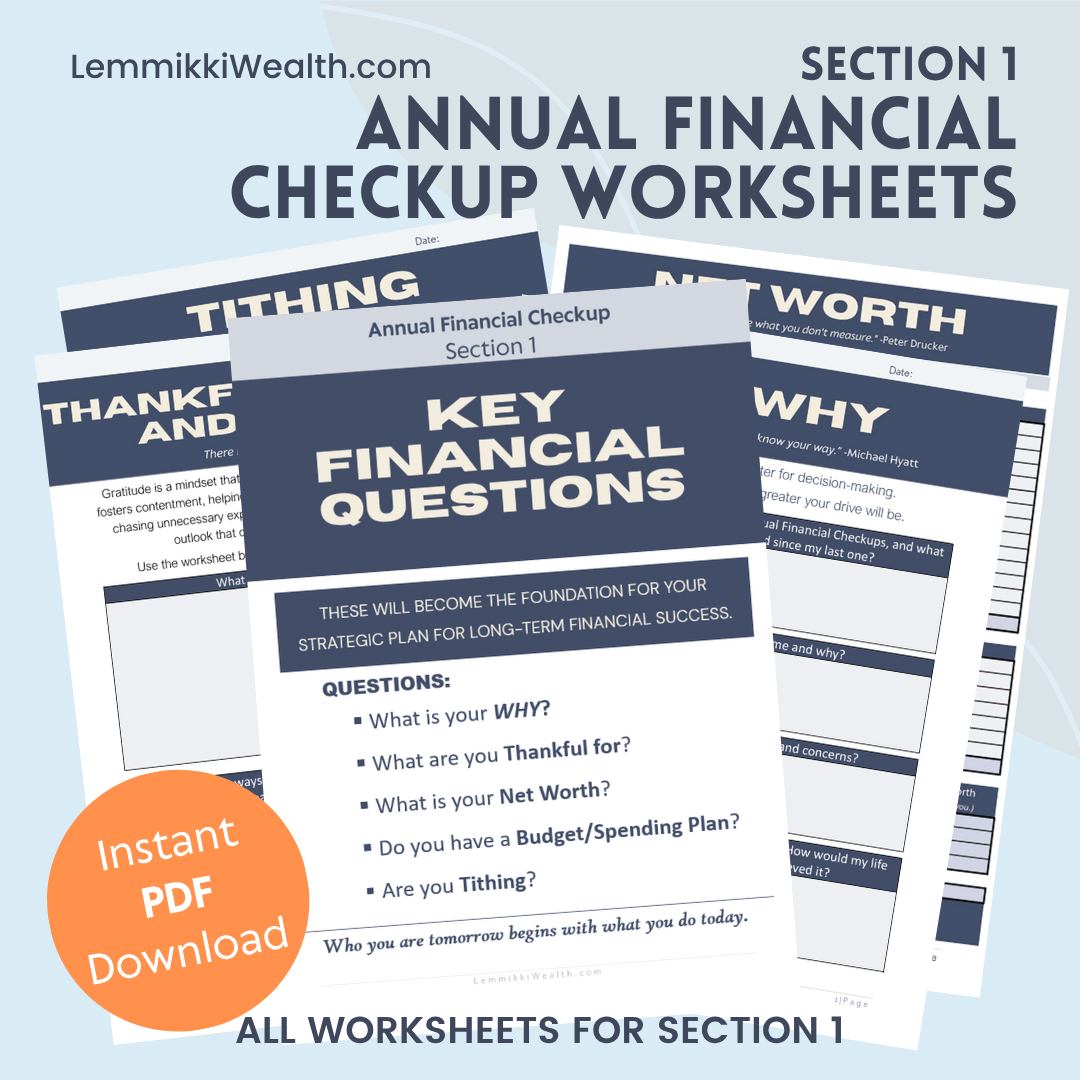

Many sections include downloadable worksheets designed to help you track your progress. As you work through these steps, print the worksheets that apply to you and attach them together, noting the date they were completed. Be sure to store your worksheets in a secure location that you can easily locate later, such as with your bills, tax documents, or a “What If” binder (which will be covered in Section 4: Safeguarding Your Legacy). This way, you can easily revisit past years and see how far you’ve come on your financial journey.

3. Start at the beginning for each review.

While it may seem redundant, it’s important to start at the beginning for each review. This is important because your life and responsibilities may have changed since your last financial review, and you may need to revisit or rework a step.

Over time, these questions will become easier to go through as you begin making financial decisions based on your own unique priorities. Before long, you’ll be surprised by your progress and just how far you can go.

Don’t compare yourself to others. Compare yourself to the YOU from a year ago.

Slow and Steady Wins the Race.

“Wealth gained hastily will dwindle, but whoever gathers little by little will increase it.”

Proverbs 13:11 ESV

Solomon’s observation here highlights the contrast between sudden wealth or dishonest gains versus honest, gradual accumulation of wealth.

Sudden accumulation or dishonest gains often vanish quickly, similar to the “lottery curse.” Since it wasn’t earned through hard work, people often lack experience in how to use, protect, or manage it.

Solomon emphasizes that honest, gradual wealth-building is far better and longer-lasting.

Reaching millionaire status typically takes an average of 27 years, with most individuals achieving this milestone around the age of 49. Initially, progress may seem slow, but the magic of compound interest gradually accelerates wealth accumulation. Think of it as a snowball rolling down a mountain—small at first but growing larger and faster over time. Do not give up!

I pray that this course can help guide and motivate you on your wealth-building journey and that you will gain lasting wealth that you can use for God’s glory and pass down for generations to come.

*Again, please note that I am not a financial advisor, and this Annual Financial Checkup should not replace professional advice from a qualified financial advisor.

All course worksheets are listed below and can also be accessed in their corresponding sections and lessons.